FTSE 100 Gains Amid US-China Trade Negotiations; FCA Addresses London Market Concerns

The chief of the Financial Conduct Authority (FCA) has declared that the rules governing listings in London are not the cause of the declining status of the city’s stock market when addressing members of Parliament.

Concerns about the London stock exchange’s viability are intensifying, especially following Wise’s announcement last week regarding its relocation of primary listing from London to New York, which represents just one of several companies to make a similar transition.

To enhance London’s appeal as a financial hub, the FCA has relaxed its listing directives.

Nikhil Rathi, FCA’s CEO, informed the Commons Treasury Committee, stating, “The listing regulations have not been highlighted as an issue by our discussions.”

Rathi attributed the challenges facing the UK exchange to various factors, including pension funds’ investment strategies in UK shares, the UK corporate governance stance on executive compensation, recent fluctuations in the pound, taxation policies, and the expansive size of the US market.

At midday, the FTSE 100 index rose by 39.53 points, or 0.45%, reaching 8,871.53, buoyed by encouraging remarks from US Commerce Secretary Howard Lutnick about the positive progress of the ongoing US-China trade discussions in London.

Additionally, the FTSE 250 index witnessed an increase of 154 points, or 0.72%, to reach 21,439.16.

In currency news, the pound experienced a decline of 0.39% against the dollar, trading at $1.35, as market participants anticipated further reduction in interest rates from the Bank of England. Recent Office for National Statistics (ONS) data indicated a sharp slowdown in wage growth and an uptick in unemployment, which reached its highest levels in nearly four years during the January to March period.

Should the FTSE 100 maintain its current position at the day’s end, it will surpass March’s closing figure of 8,871.31.

In other news, beverage conglomerate Diageo is contemplating liquidating its stake in the Royal Challengers Bengaluru (RCB) cricket team for an estimated $2 billion.

Reports suggest that Diageo is weighing the options for a full or partial sale of its investment in RCB, which recently secured its first Indian Premier League (IPL) championship victory, according to Bloomberg.

RCB, previously known as Royal Challengers Bangalore, is owned by the Bangalore-headquartered United Spirits, where Diageo holds a controlling interest of 55.9%.

Diageo initially entered United Spirits in 2012 following Vijay Mallya’s relinquishment of control due to his financial struggles with Kingfisher Airlines.

This sale consideration arises concurrently with calls from India’s health ministry advocating for an IPL ban on alcohol and tobacco marketing.

Meanwhile, the FCA has revised minimum disclosure standards for private companies wishing to trade shares on emerging mini stock exchange venues.

New FCA regulations specify that these platforms will be dubbed Pisces, which stands for Private Intermittent Securities and Capital Exchange Systems.

Officials from the FCA anticipate the launch of one or two Pisces exchanges within a few months, with trading expected to commence by year-end. The London Stock Exchange is among those planning to offer a Pisces platform, alongside several firms expressing interest.

Under the finalized rules, private companies trading shares on these platforms will no longer be required to furnish forward-looking financial disclosures.

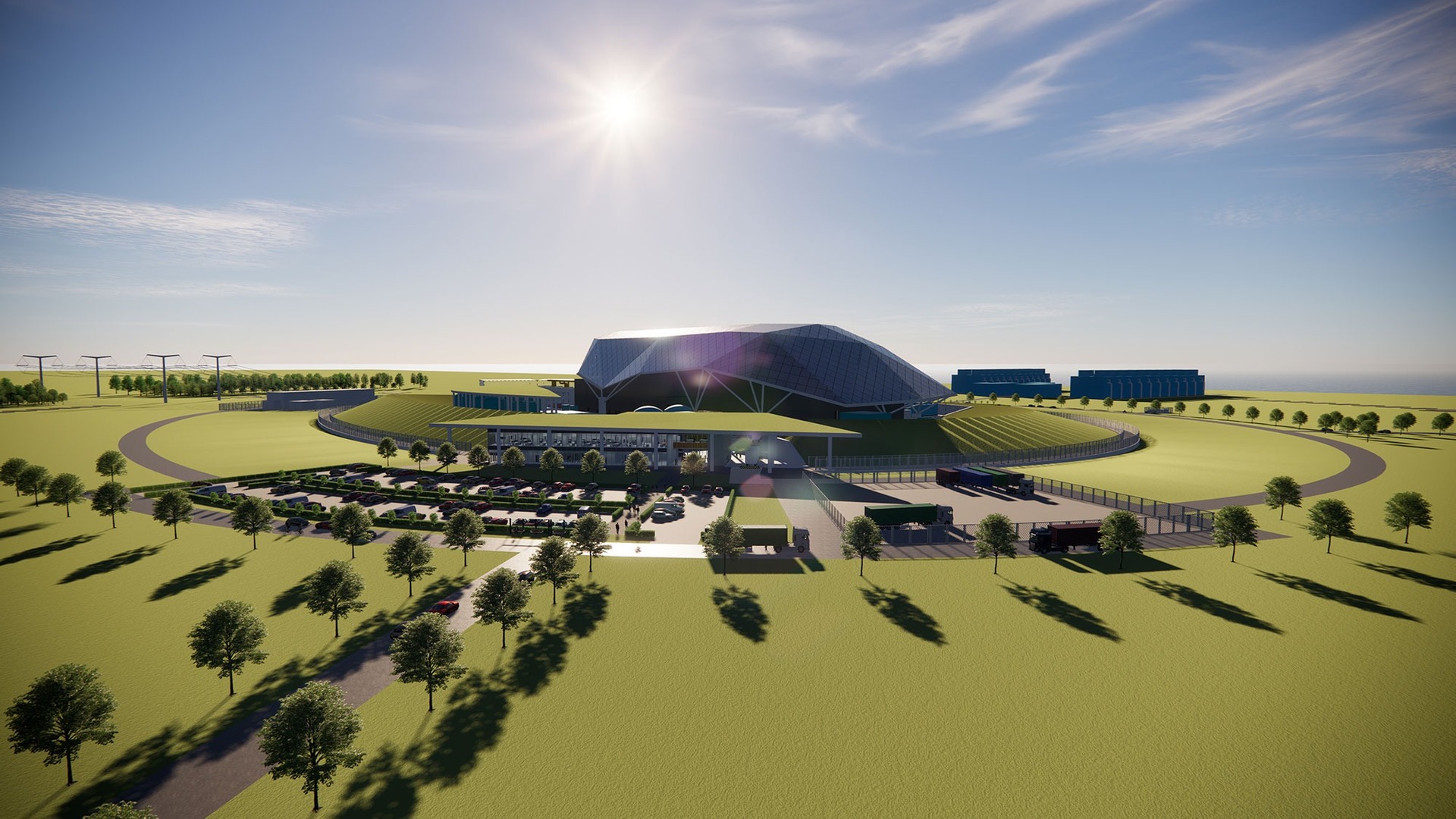

In commitment to job creation, Rolls-Royce has pledged to oversee the establishment of thousands of new jobs after securing government approval to construct three small nuclear reactors aimed at supplying energy to three million homes (Robert Lea reporting).

Rolls-Royce SMR, a subsidiary, has harnessed technology derived from decades-long experience supporting the Royal Navy’s nuclear submarine fleet. The UK government has allocated £2.5 billion for the small modular reactor (SMR) initiative over the forthcoming four years,

Rolls-Royce’s CEO, Tufan Erginbilgic, framed this collaboration as a validation of the company’s exceptional nuclear capabilities.

The company’s shares surged to a record high this morning, climbing 2%, or 19p, to reach 907p. Rolls-Royce’s shares have appreciated by 54% this year, driven by reforms under Erginbilgic’s leadership and increased defense expenditure.

Bellway’s affirmation of a thriving spring sales season has mitigated sector concerns, according to property correspondent Tom Howard.

“Panic had begun to surface regarding the market’s strength during April and May due to the upheaval caused by Donald Trump’s trade dispute, which affected financial markets and consumer confidence,” he noted.

“Those concerns intensified recently when MJ Gleeson indicated it had to offer more incentives to sell homes while lamenting rising construction costs and stagnant prices.”

Bellway’s positive outlook led to a share price jump of 120p, or 4.5%, reaching £27.94 this morning.

Larger competitors also reported gains, with Vistry ascending 29p, or 4.9%, to 627p, and Persimmon increasing by 49.5p, or 3.8%, to £13.52.

Marks & Spencer has resumed taking online orders nearly two months post a significant cyberattack.

The retailer announced that “a range of our leading fashion products will be available for delivery across England, Scotland, and Wales,” with Northern Ireland scheduled to see delivery options return soon.

“In the following days, we will add more fashion, home, and beauty items, and plans are underway to restore click-and-collect, next-day, nominated-day delivery, and international orders.”

Despite ongoing recovery efforts, the fallout from the cyberattack is substantial, with M&S estimating a £300 million hit to annual operating profits. The company acknowledged that online sales have been “seriously affected and are still on the path to recovery.”

Meanwhile, housebuilders emerged as the top gainers in the FTSE 100 after Bellway revised upward its target for new home constructions this year.

Marks & Spencer benefitted from news of its website’s revival, after its shutdown following a cyber-attack six weeks prior.

WPP remains under pressure, registering the largest declines after announcing CEO Mark Read’s departure yesterday.

The FTSE 100 commenced trading 0.4% up, or 34 points, reaching 8,865.35, as the second day of trade talks between the US and China unfolds in London amidst signs of a potential thaw in relations.

Commerce Secretary Howard Lutnick described the discussions as “fruitful.”

The pound dipped against the dollar, now at $1.3477, amid indications of a cooling labor market and a strengthening US currency, which rebounded after its decline on Monday. Gold prices saw a slight uptick, reaching $3,327.47 per ounce.

With payrolls declining, unemployment rates rising, and wage growth faltering, the latest labor market data reinforces beliefs that the Bank of England may cut interest rates more aggressively than currently anticipated, potentially reaching 3.5% by next year, according to Ruth Gregory of Capital Economics.

“Feedback from our vacancy survey indicates hesitation among companies concerning new hiring or filling positions left by departing workers,” noted Liz McKeown from the ONS.

“Six months post the launch of Get Britain Working, we are observing positive trends with economic activity hitting record levels, alongside a rise of 500,000 people in employment since our administration began, and real wage growth exceeding that witnessed in the decade after 2010,” stated Alison McGovern, employment minister.

Data released by the tax authority alongside the ONS labor market summary portrayed a rapid erosion of payroll employment, the quickest since the early pandemic days in May, with over 109,000 positions lost in that month—the steepest one-month drop since May 2020. On an annual basis, payrolls have seen a reduction of 274,000.

The diminishing payroll figures follow the increased national insurance contributions that took effect in early April, amounting to £25 billion.

Private sector surveys had previously indicated that businesses are cutting back on personnel and hiring due to the tax increase.

Bellway has reported stable performance throughout the spring selling season, highlighting heightened customer confidence and rising reservation rates.

Reflecting on the improved trading conditions, Bellway elevated its full-year output forecast to between 8,600 and 8,700 homes, up from 8,500.

Additionally, FirstGroup—the transport company—has returned to profit.

The firm disclosed pre-tax earnings of £169.6 million for the fiscal year up to March 29, rebounding from a loss of £24.4 million the prior year. Revenue during this time increased to £5.06 billion, compared to £4.71 billion in the preceding year.

Rolls-Royce has been appointed as the preferred partner by Great British Energy for the development of the nation’s inaugural small modular nuclear reactors.

The initiative is projected to support approximately 3,000 jobs at peak construction, providing energy to about three million homes.

Recent data reveals a slowdown in wage growth in the UK for the three months ending in April, alongside an increase in unemployment to levels not seen since the conclusion of pandemic lockdowns in 2021.

Average wage increases, excluding bonuses, stood at 5.2% for the period, decreasing from 5.5% in the previous month, according to the Office for National Statistics. Expectations had projected a moderation to 5.3%.

The unemployment rate rose to 4.6%, compared to 4.5%, marking the highest joblessness rate since July 2021.

Bank of England Governor Andrew Bailey indicated to MPs last week that further reductions in wage growth would be essential before the central bank considers additional interest rate cuts.

Post Comment